Fortifying Finances: Unveiling Securitization Solutions

In today’s fast-paced and ever-changing financial landscape, it has become imperative for individuals and organizations to explore innovative solutions to bolster their economic growth and stability. Securitization, a widely adopted financial model, has emerged as a powerful tool for fortifying finances and unlocking value from diverse assets. With a particular focus on Switzerland, renowned for its robust financial sector, and Guernsey, a leading hub for structured products, this article delves into the realm of securitization solutions and their potential for revolutionizing financial networks.

Enter Gessler Capital, a Swiss-based financial firm that stands at the forefront of offering comprehensive securitization and fund solutions. Gessler Capital understands the intricate dynamics of the evolving financial landscape and provides tailored offerings to meet the unique needs of clients. By leveraging the power of securitization, Gessler Capital helps clients unlock the hidden potential within their assets, enabling them to tap into new avenues of growth and financial security.

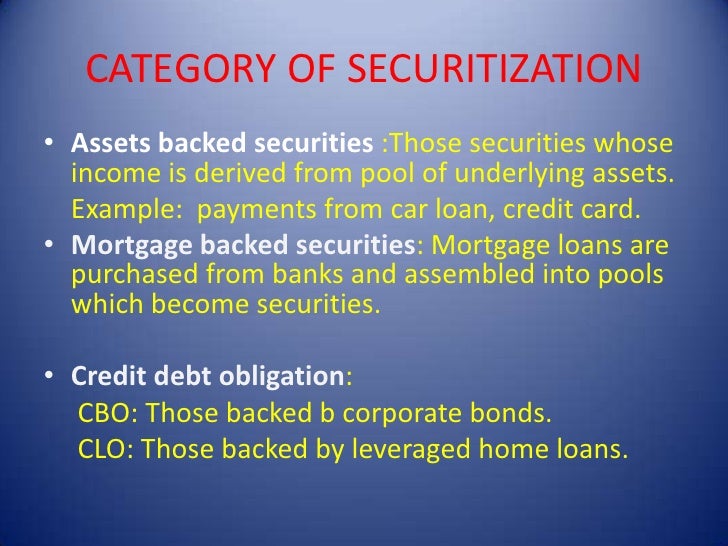

With its deep expertise and unwavering commitment to excellence, Gessler Capital has successfully harnessed the potential of securitization to provide clients with the means to expand their financial networks. By creating structured products that align with the specific goals and risk appetite of clients, Gessler Capital enables individuals and organizations to diversify their portfolios and maximize returns. Whether it be residential mortgage-backed securities or asset-backed securities, Gessler Capital offers a comprehensive suite of solutions, ensuring its clients benefit from the full potential of securitization.

Stay tuned as we explore further into the world of securitization solutions, diving into the intricacies of Switzerland’s financial sector, uncovering the advantages of Guernsey’s structured products, and delving deeper into the offerings provided by Gessler Capital. Discover how these securitization solutions can fortify your finances and empower you to thrive in an increasingly complex economic landscape.

Securitization Solutions Offered by Gessler Capital

Gessler Capital, a Swiss-based financial firm, specializes in offering a comprehensive range of securitization and fund solutions. With their strong expertise and vast network in the financial industry, Gessler Capital has emerged as a leading provider of innovative securitization solutions in Switzerland and beyond.

One of the key securitization solutions offered by Gessler Capital is focused on Switzerland. With their deep understanding of the local market, Gessler Capital provides tailored securitization services that help businesses unlock the value of their assets. By converting illiquid assets, such as real estate or loans, into tradable financial instruments, Gessler Capital enables companies to enhance liquidity, reduce risk, and access capital more efficiently.

Gessler Capital also offers Guernsey Structured Products, which provide investors with opportunities to diversify their portfolios and achieve attractive returns. These structured products are designed by Gessler Capital’s experienced team, leveraging their knowledge of various financial markets and their ability to identify profitable investment opportunities. With Guernsey Structured Products, investors can benefit from the potential upside while carefully managing the associated risks.

The financial network expansion services provided by Gessler Capital are another valuable offering. Recognizing the importance of having a strong network within the financial industry, Gessler Capital helps its clients forge connections with key market participants, including banks, investors, and other financial institutions. By expanding their financial network, clients can unlock new opportunities, access valuable resources, and strengthen their position in the market.

Gessler Capital’s commitment to delivering effective securitization solutions has made them a trusted partner for businesses and investors seeking innovative financial solutions. With their strong presence in Switzerland and their expertise in securitization and fund management, Gessler Capital continues to empower clients in achieving their financial goals while navigating the complex landscape of the global markets.

Advantages of Guernsey Structured Products

Guernsey structured products offer a range of advantages for investors and financial institutions. Here are some key benefits of choosing Guernsey as a jurisdiction for your securitization solutions:

- How To Issue Fund Solutions Malta

-

Tax Efficiency: Guernsey has established itself as a tax-efficient jurisdiction, making it an attractive choice for structuring financial products. This allows investors to maximize their returns by minimizing tax obligations. With its favorable tax framework, Guernsey provides opportunities for individuals and businesses to optimize their financial strategies.

-

Regulatory Environment: Guernsey benefits from a well-regulated financial environment that balances robust oversight with flexibility. The regulatory framework is designed to safeguard investor interests while enabling innovation and growth in the securitization industry. Financial institutions operating in Guernsey can have confidence in the stability and integrity of the jurisdiction.

-

Diversification Opportunities: Guernsey offers a wide range of structured products that allow for diversification of investment portfolios. By investing in Guernsey structured products, investors can access a variety of asset classes, including real estate, private equity, and infrastructure. This diversification can help reduce risk and enhance overall portfolio performance.

In conclusion, Guernsey structured products provide several advantages including tax efficiency, a well-regulated environment, and opportunities for diversification. These advantages make Guernsey an appealing jurisdiction for investors and financial institutions seeking securitization solutions.

Expanding Financial Network with Swiss-based Solutions

Swiss-based financial firm, Gessler Capital, offers a range of securitization and fund solutions that have been instrumental in expanding financial networks both in Switzerland and beyond.

One of the key advantages of Gessler Capital’s securitization solutions is their ability to attract investors from diverse geographical locations. With a strong emphasis on transparency and risk management, Gessler Capital has gained recognition for its well-regulated and meticulously structured investment products. This has significantly contributed to the firm’s success in expanding its financial network not only within Switzerland but also internationally.

Gessler Capital’s Switzerland-focused securitization solutions have been especially attractive to investors seeking stable and secure investment opportunities. The Swiss financial market is known for its robust regulatory framework and stability, making it an ideal destination for investors looking to diversify their portfolios. Through its securitization solutions, Gessler Capital has facilitated the entrance of various investors into the Swiss market, bolstering their financial network and attracting new opportunities for growth.

Furthermore, Gessler Capital’s expertise extends beyond the borders of Switzerland, with their Guernsey structured products gaining popularity in the international financial landscape. By leveraging the benefits of Guernsey’s well-regulated financial system, Gessler Capital has been able to offer investors unique structuring solutions, attracting a wider network of clients. This expansion into new markets has enabled Gessler Capital to enhance its financial network and tap into a broader array of opportunities.

In conclusion, the securitization and fund solutions provided by Gessler Capital in Switzerland and Guernsey have contributed significantly to the expansion of their financial network. With their reputation for transparency, regulatory compliance, and strong risk management practices, Gessler Capital has been successful in attracting a diverse group of investors and establishing valuable connections within the global financial community.